- Health

- Motor

- Life

- Other Insurance

- Corporate

- About US

- Blog

- Tools

- Support

-

157.39 <sup>USD</sup> 198.95 <sup>GBP</sup> 172.22 <sup>EUR</sup> 24.22 <sup>UGX</sup> 15.99 <sup>TZS</sup> USD : 0.00

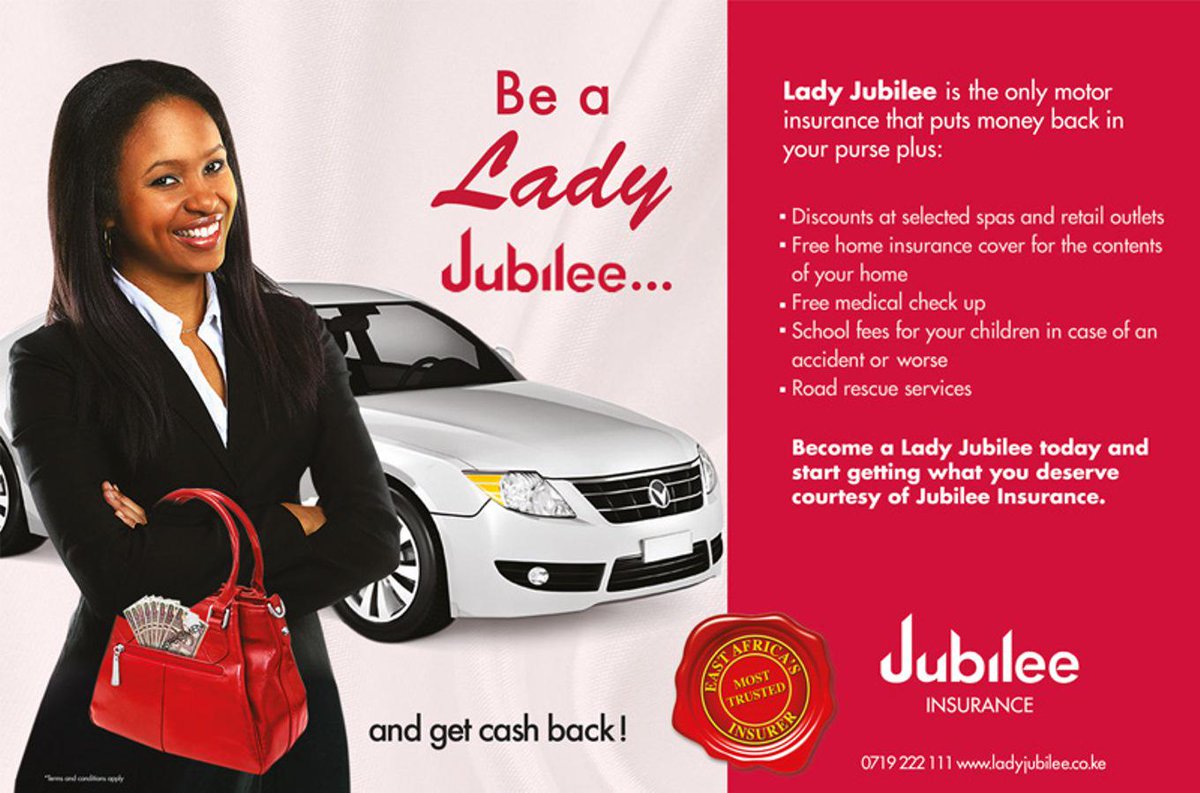

The Lady Jubilee cover is specially made for female drivers of private vehicles which has additional benefits beside those offered by other motor insurance covers, the product was designed since lady drivers have proven to be safer drivers. In comparison to the Jubilee car insurance policy in Kenya, this special cover for lady drivers has cheaper pricing and better range of benefits and limits of liability. Worldwide from the least to the most developed countries, ladies have been proven to statistically be better drivers and as a result enjoy discounted pricing on car insurance policies not just here in Kenya but overseas as well. It is because of the reasons below that ladies enjoy these discounts:

In analyzing the factors above, it was concluded that female drivers are have a much lower accident frequency, have less speeding tickets than their male counterparts. In fact, global statistics show that speeding is more likely to be a factor for men (24%) than for women (15%). Lastly, female car insurance policy holders are less likely to drive impaired or under influence of alcoholic substances (DUI). A research conducted in the USA, the FBI reported that 716,398 men were arrested for DUIs compared to 221,778 women in 2010.

For a lady to acquire the Lady Jubilee car insurance policy, she must fulfill the following conditions;

It is important to note that the Lady Jubilee car insurance policy is comprehensive in nature and therefore the benefits in an addition to the standard third party car insurance policy in Kenya.

The Lady Jubilee cover has 3 options that are based on the value of customer’s motor vehicle

Lady Jubilee cover has a number of benefits, with the extent of the cover based on the value of the car:

| BRONZE | GOLD | PLATINUM | |

|---|---|---|---|

| Hand bag contents | 5,000 | 10,000 | 20,000 |

| School fees (Upon Death or Permanent Disability) | 250,000 | 500,000 | 1,000,000 |

| Home Insurance (content cover) | 100,000 | 250,000 | 500,000 |

| Personal Accident for Insured | 100,000 | 200,000 | 300,000 |

| Accommodation after accident | 5,000 | 10,000 | 20,000 |

| Forced ATM withdrawal | 20,000 | 30,000 | 40,000 |

| Preloaded oil Libya Fuel card | 500,000 | 1,000,000 | 1,500,000 |

| Shopping vouchers | 500,000 | 1,000,000 | 1,500,000 |

The cover also has benefits that are free;